What is Ecommerce Bookkeeping and Why is it Important?

This article centers on bookkeeping for online sellers. You’ll gain insights into tracking sales, comprehending expenses, and interpreting financial reporting. For further guidance on utilizing ecommerce accounting software, contact our experts anytime.

Reading time: 18 min.

Ecommerce bookkeeping is more complex than traditional accounting. That’s why even if you’re adept at keeping track of financial records, you’ll still need a wealth of additional knowledge to ensure your online store’s accounting is well-maintained.

When starting an online store, ecommerce entrepreneurs usually need to think more about handling their bookkeeping process, as understanding your financial data accurately is crucial for achieving success and growing a truly thriving business. Facing challenges such as running out of funds or struggling with pricing and costs is a significant reason why many ecommerce businesses fail quite early on.

In this article, IntexSoft will provide you with key information about cash flow, inventory management, and other central aspects of commerce bookkeeping.

Let’s dive in.

Ecommerce accounting operates as the intricate framework behind the curtains, capturing, organizing, and guiding financial aspects that drive the operations of online businesses. Influential sales platforms like Amazon and Shopify introduce financial challenges that necessitate specialized attention, making life more difficult for businesses. This is where ecommerce accountants step in to navigate and help address these pitfalls.

Let’s look at the table below to gain insights into the main areas covered by ecommerce accounting’s three primary domains:

|

Domain of ecommerce accounting

|

Features

|

| Bookkeeping | This domain involves the careful tracking and categorization of a diverse range of e commerce store transactions, encompassing everything from sales to purchases. The goal is to establish a well-organized system of record-keeping. Bookkeepers also handle payroll management and accounts payable responsibilities, ensuring financial order.

|

| Sales tax assessment | E commerce businesses navigate sales tax registration, accurately remitting sales tax and filing, and the management of various state and local taxes. Additionally, international sales tax obligations such as VAT and GST require careful handling.

|

| Financial analysis | This entails evaluating the profitability of products, identifying avenues for revenue growth, analyzing metrics related to growth, and forecasting cash flow.

|

At the heart of accounting lies a crucial mission: to arm you with the financial insight necessary to steer your organization in the right direction. As the table shows, e commerce bookkeeping revolves around monitoring every financial transaction, encompassing purchases, sales, expenditures, managing conversion rates for foreign currency, and incoming payments. But it doesn’t stop there – it also manages crucial data such as the cost of goods sold, ensures timely payroll processing, and meticulously records even the minutest expenses.

Remarkably, when it comes to bookkeeping differences, Amazon FBA and Shopify businesses share more similarities than differences. The foundational principles of bookkeeping stand unwavering, irrespective of the specific flavor of ecommerce enterprise you’re steering.

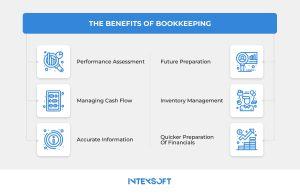

Whether you’re peddling wares through Shopify, BigCommerce, Magento, Amazon, Etsy, eBay, or other ecommerce platforms, the advantages of establishing the right bookkeeping solution extend far and wide:

However, the primary among these advantages is securing the survival of your business.

Maintaining a steady financial course is essential for online store owners and competent e-commerce accountants. Understanding your financial direction empowers you to manage expenses and foster continuous profit growth. Here are the financial documents you need to consider:

When you run your online store on platforms like Shopify or BigCommerce, there are additional costs known as merchant fees. These platforms offer various advantages, such as easy setup and improved search visibility, but they do charge a small portion from each sale you make.

This arrangement can create complexity in your bookkeeping service. The money you receive in your bank account is actually the net amount after the ecommerce platform deducts its fee. To accurately reflect this in your records, you need to document the total sale amount, then indicate the difference between that figure and the deposited amount as “merchant processing fees.”

When you make a sale using Shopify’s ecommerce platform, the payment processing is handled by Stripe (and remember, there’s a merchant fee involved as discussed earlier). Now, if a customer decides to return the purchased item after a week, it raises a question: where is this return documented? When multiple third-party tools are in play, tracking can become tricky.

Adding to this, many payment processors (Stripe included) typically don’t reimburse the merchant fee when an item is returned by a customer. As a result, your business incurs a loss represented by that fee, and this needs to be accurately reflected in your accounting records.

Many e-commerce platforms come with built-in inventory tracking features. This simplifies the process of monitoring and overseeing your inventory for online sales through your store.

However, if you’re selling across multiple online platforms your primary platform won’t capture changes in inventory resulting from sales made elsewhere. In other words, your Shopify inventory won’t reflect your Amazon sales.

This highlights the crucial need for a centralized inventory tracking system, even if it doesn’t automatically update your accounting records. Having this central hub is vital. If you decide to collaborate with a bookkeeper, they can manage inventory and use this centralized inventory information to create accurate records of sales, returns, and replenishments in your financial books.

The majority of the payments you’ll receive will likely come from customer credit cards. However, it’s also possible to accept various forms of payment, especially if you have in-person sales.

Certain e-commerce platforms are designed to track sales made using methods like cash, checks, gift cards, and credit. If you intend to offer these payment options, it’s important to ensure that your chosen bookkeeping solution can effectively handle these types of sales.

While offering different payment methods can enhance customer convenience, it’s important to note that they can complicate matters from a bookkeeping standpoint. For instance, if you receive a payment in cash or by check, the sale won’t be fully recorded in your books until you deposit that money into your bank account.

In the case of gift cards, a typical transaction involves receiving payment from a customer and giving them a gift card in return. This inflow of cash is categorized as unearned revenue in your books because no goods have been exchanged yet.

E-commerce allows you to sell products worldwide, and many ecommerce platforms make it convenient to offer products in various currencies. However, when you engage in sales and shipments to foreign countries, your e commerce bookkeeping might require extra details to accurately account for those transactions.

For instance, it becomes necessary to have information about both the gross sale amount and the associated merchant fees in the foreign currency. This information is essential to reconcile the sale with the eventual deposit you receive in your local currency. The reconciliation involves using the precise conversion rate applied by your e-commerce platform to switch between currencies.

Should you offer free shipping or charge customers? Some platforms integrate with shipping systems, handling charges and postage. Remember, platforms may take a cut. The shipping fees you charge might not match actual costs.

There are two ways to track this:

Compare differences as needed.

Managing sales tax effectively is a key responsibility for e-commerce businesses. While some platforms handle both the collection and payment of sales tax, others only collect it from customers, meaning you’re responsible for ensuring the tax reaches the appropriate government entity.

From a bookkeeping perspective, it’s important to understand that sales tax isn’t treated as revenue. It’s a liability that must be remitted to the government. As a result, your financial records should clearly distinguish between gross sales, sales tax, merchant fees, and the final bank deposit.

Your records should include:

It’s important to note that the exact percentage of sales tax can vary based on your location.

As businesses adopt and adapt, ecommerce stores inevitably encounter new obstacles involving inventory tracking, financial records, and shipping logistics. And such challenges are quite risky for any ecommerce founder. At this point, you also probably understand the importance of bookkeeping for ecommerce.

You can manage this task independently using do it yourself accounting software or relying solely on a traditional bookkeeper. However, these methods can bring about certain challenges. Unless you have a strong background and expertise in bookkeeping or ecommerce accounting, you might miss details.

IntexSoft has simplified matters and saved time for many business owners through an automated bookkeeping service. Do you require consultation and support? For further insights, don’t hesitate to reach out to us.

E-commerce bookkeeping involves carefully tracking and managing the financial activities of an online business. It ensures accurate recording of net sales, expenses, and overall economic well-being, functioning as a guide to navigate through the complex digital business environment. This practice helps you stay on course and make informed decisions as you navigate the digital economy.

Bookkeeping solution is essential due to its multifaceted role in maintaining all your financial data clarity. Here’s why:

Should you hire a bookkeeper for your ecommerce business? It comes down to a few things.

If your e commerce business business is growing and you’re dealing with lots of sales, a bookkeeper can help keep everything organized and ensure you follow the rules.

But if your business is smaller and your sales channels aren’t too complicated, you might be able to handle the money stuff yourself, especially with some help from accounting tools.

Think about how comfortable you are with money stuff, how fast your business grows, and how much money you have to spend. That should help you figure out whether you need an ecommerce bookkeeper or not.

In essence, accounting bookkeeping software streamlines your common tasks, making financial management for your ecommerce business more efficient and accessible. Here’s a breakdown of the benefits:

When looking for accounting software to help with your ecommerce bookkeeping process, there are different options designed specifically for online businesses. These software tools are designed to assist you in handling your money matters like transactions, expenses, and creating reports. Some well-known choices are QuickBooks Online, Xero, FreshBooks, and Zoho Books, among others. They work together with your e commerce platforms, making it easier to create invoices and giving you a better understanding of how your business is doing financially.

For ecommerce businesses, important financial statements include:

Think of ecommerce bookkeeping services as a guiding map for your business’s growth. This map reveals the sources of your income and where your funds are being spent. Studying this map lets you identify your most profitable products, discover areas to cut costs, and strategize to expand your business. Additionally, it demonstrates your business’s success to others, potentially attracting more support. Moreover, it enables you to plan ahead and guarantee a steady financial flow to sustain your operations. Essentially, consider ecommerce bookkeeping as your business’s roadmap to improvement.