This comprehensive guide explores the multifaceted landscape of valuing an E-commerce venture. From dissecting financial statements to evaluating customer engagement, each facet of the valuation process holds the key to unlocking the true potential of a business.

Reading time: 17 min.

Understanding the true worth of a business is a pivotal skill for entrepreneurs, investors, and stakeholders alike. However, this process is far from straightforward, often involving a complex interplay of financial data, market dynamics, and operational intricacies.

Behind every revenue stream, customer base, and functional facet lies a story of value waiting to be unveiled. Whether you’re an astute investor, an enterprising entrepreneur, or a business owner contemplating a strategic move, understanding the intricate process of E-commerce valuation is paramount.

This comprehensive guide explores the multifaceted landscape of valuing an E-commerce venture. From dissecting financial statements to evaluating customer engagement, each facet of the valuation process holds the key to unlocking the true potential of a business.

Through systematically exploring critical factors and insightful analysis, we’ll demystify the process of valuation, empowering you to make informed decisions in the dynamic world of online commerce.

Join us as we delve deep into the critical factors that underpin an E-commerce venture’s intrinsic worth. By the end of this guide, you’ll be equipped with the knowledge and tools to navigate the complexities of valuing an E-commerce business with confidence and precision. Let’s unlock the full potential of your E-commerce venture.

In order to accurately determine the value of an ecommerce business, it is imperative to embark on a comprehensive assessment that delves into a multitude of critical components. This entails a systematic deconstruction of the business’s intricate workings. Let’s dissect the fundamental steps that underpin this evaluative.

Financial Statements Analysis

Begin by examining the business’s financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide crucial insights into revenue, expenses, assets, and liabilities.

Revenue Streams Assessment

Identify and evaluate the different sources of revenue. This can include product sales, subscription models, advertising, affiliate marketing, and other monetization strategies.

Customer Base Evaluation

Analyze the customer base. Consider the number of active customers, demographics, purchasing behavior, and customer retention rates. A loyal and engaged customer base adds significant value.

Traffic Sources and Conversion Rates

Scrutinize the sources of web traffic. Understand whether it’s predominantly organic, paid, or referral. Additionally, analyze conversion rates to assess the efficiency of turning traffic into sales.

Competitive Landscape Analysis

Investigate the competitive landscape. Identify key competitors, their market share, strengths, and weaknesses. This contextual information is essential for understanding where the ecommerce business stands in the market.

Unique Selling Proposition (USP) and branding

Determine what sets this ecommerce venture apart from others. This could be exceptional product quality, a seamless shopping experience, unique product offerings, or outstanding customer service.

Inventory and Supply Chain Management

Assess the efficiency of inventory management. Look at turnover rates, obsolete stock, and relationships with suppliers. A well-managed supply chain can significantly impact the business’s overall value.

Technology Stack and Infrastructure

Evaluate the technology supporting the business. This includes the ecommerce platform, hosting infrastructure, and any proprietary software. A robust and scalable tech setup is an invaluable asset.

Legal and Regulatory Compliance

Ensure the business adheres to all relevant laws and regulations. This encompasses licenses, trademarks, GDPR compliance, and pending legal matters.

Future Growth Prospects

Consider the scalability and potential for growth. Research whether it is possible to use unused markets, product lines, or marketing strategies to increase future income.

By meticulously examining these facets, you’ll be well-equipped to determine the true worth of an ecommerce business. Remember, a comprehensive assessment ensures that decisions made in this dynamic and competitive landscape are well-informed and strategic.

An E-commerce valuation multiple is a financial metric used to estimate the value of an E-commerce business relative to a specific financial indicator. It provides a comparative measure that helps potential buyers, investors, and stakeholders assess the worth of the business.

Common E-commerce valuation multiples include:

This multiple compares the enterprise value of the E-commerce business to its annual revenue. It indicates how much investors will pay for each dollar of income generated.

This multiple compares the market price per share of the E-commerce business to its earnings per share (EPS). It reflects the price investors will pay for each dollar of earnings.

Specific to E-commerce, this multiple assesses the business’s market price in relation to its total gross merchandise value, which represents the total value of goods sold on the platform before deductions.

This multiple compares the market price of the E-commerce business to the cost of acquiring each customer. It is relevant for e commerce businesses heavily focused on customer acquisition and growth.

This multiple evaluates the E-commerce business’s market price relative to a customer’s projected lifetime value. It is essential for subscription-based models and online businesses with solid customer retention.

This multiple assesses the market price in relation to the average value of each customer order. It provides insight into customer spending behavior.

These multiples offer different perspectives on the value of an E-commerce business, depending on the specific financial indicator used. It’s essential to consider industry standards, market conditions, and the company’s unique characteristics when interpreting and using these multiples for valuation purposes.

Determining the valuation multiple of your E-commerce business is a pivotal aspect of understanding its worth in the market. This guide provides a comprehensive breakdown of the steps involved in this intricate process.

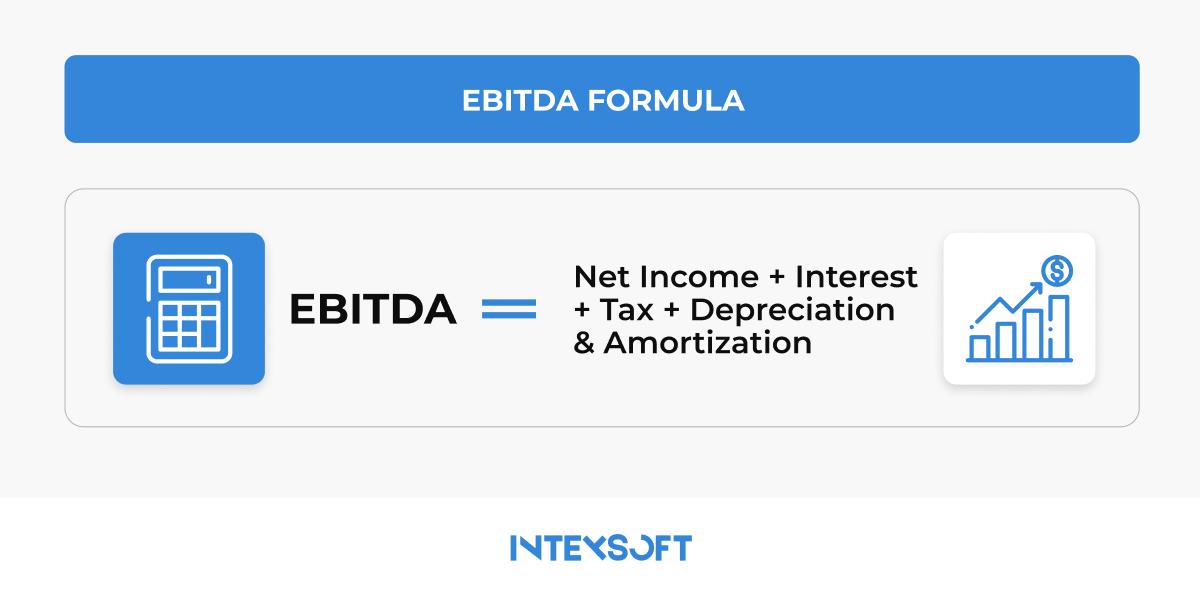

Gather comprehensive data for your business. This includes revenue, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and any other relevant financial metrics over a significant period.

Identify publicly traded E-commerce companies or recent transactions in the same industry. Compare their valuation multiples to your business to derive insights into potential valuations.

Stay abreast of industry trends and benchmarks. Understanding how similar E-commerce businesses are valued in the current market climate provides valuable context for your valuation.

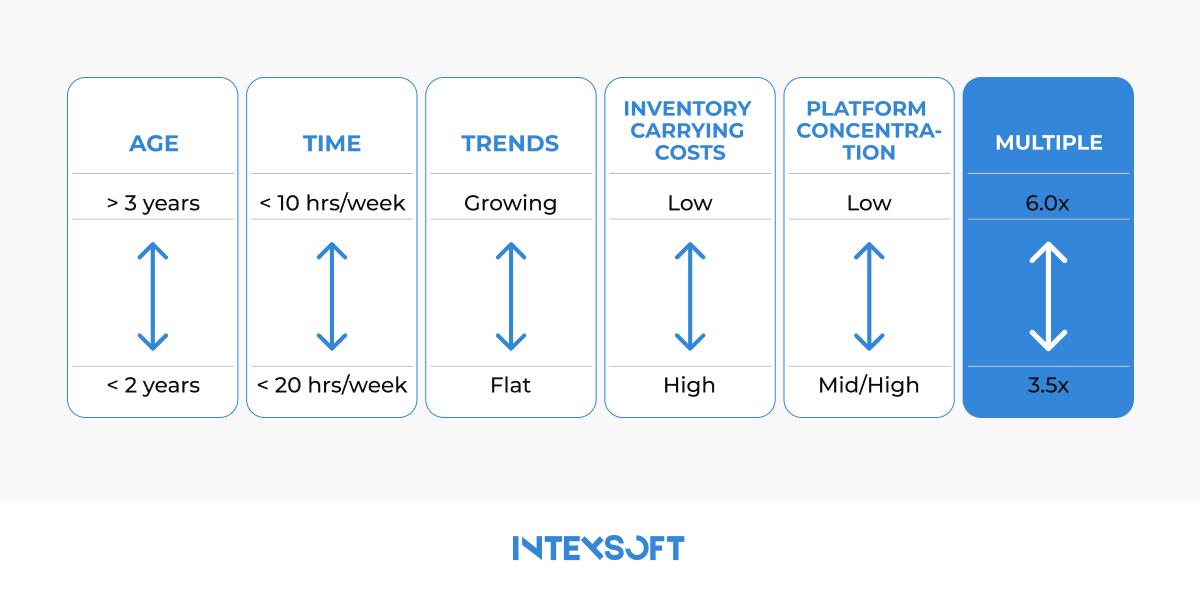

Recognize the variables that can influence multiples. Factors like growth rate, profitability, market share, competitive positioning, and overall industry conditions play a role.

Consider any special circumstances that may warrant adjustments to the multiple. These could include market-specific risks, synergies with potential buyers, or unique competitive advantages.

If using multiple metrics (e.g., EV/Rev and P/E), calculate a weighted average based on their relative importance to your business.

Conduct sensitivity analyses to understand how changes in key assumptions (e.g., growth rate, profitability) affect the valuation multiple.

Engage with financial advisors or valuation experts who specialize in E-commerce businesses. Their expertise can provide valuable insights and ensure a comprehensive and accurate valuation.

Remember, the E-commerce valuation multiple is just one aspect of determining the overall worth of your business. Combining this with a detailed analysis of financial statements, customer base, competitive landscape, and other factors will yield a more comprehensive understanding of your E-commerce venture’s actual value.

There are several key methods for valuing an E-commerce business. Each method provides a unique perspective on the business’s worth, allowing for a comprehensive assessment.

The Seller’s Discretionary Earnings (SDE) method focuses on the discretionary income generated by the business. It accounts for the owner’s salary, benefits, and other expenses not directly related to the core operations. The SDE multiple is then applied to arrive at the business’s value.

This method is particularly suitable for small businesses or those with a single owner-operator. It provides a clear picture of the income a new owner can expect, including the financial benefits the current owner receives.

However, it’s essential to carefully define and calculate the discretionary expenses to ensure an accurate valuation. Market conditions and industry standards should also be considered when determining the appropriate SDE multiple.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a widely accepted measure of a business’s operating performance. This method involves applying an EBITDA multiple to estimate the business’s value.

EBITDA is particularly relevant for mid-sized to large enterprises. It clearly indicates the business’s operational profitability, making it valuable for investors and buyers.

Assessing and normalizing EBITDA is crucial, ensuring it accurately reflects the business’s true earning potential. Additionally, industry-specific EBITDA multiples should be considered for a more accurate valuation.

This method involves applying a multiple to the business’s annual revenue. It offers a straightforward approach, especially for startups or high-growth businesses, as revenue is often a key performance indicator.

This method is most useful when the business is growing and may still need to generate significant profits. However, it may need to be more accurate for companies with low-profit margins.

Understanding the industry’s standard revenue multiples and considering any unique factors affecting revenue generation is essential.

DCF is a comprehensive method that estimates the present value of future cash flows generated by the business. It considers projected revenue, expenses, and other financial factors, discounting them to their current value.

DCF is suitable for ecommerce businesses with stable and predictable cash flows. It provides a forward-looking perspective on the business’s value.

Accurate financial projections and an appropriate discount rate are crucial for a practical DCF analysis. Additionally, uncertainties in future cash flows should be carefully considered.

This method involves examining the prices at which similar ecommerce businesses have been sold recently. It provides a real-world benchmark for the business’s value based on actual market transactions.

Precedent sales are particularly useful when a sufficient pool of comparable sales data is available. It offers tangible evidence of market value.

Ensure that the businesses used for comparison are genuinely similar in terms of industry, size, growth potential, and other relevant factors. Adjustments may be needed to account for any differences.

Each of these methods has its strengths and limitations, and the most appropriate one depends on factors like the size of the business, its profitability, growth trajectory, and industry norms. Often, a combination of methods is used to arrive at a more reliable valuation. It’s important to note that seeking professional advice from a financial advisor or valuation expert can greatly enhance the accuracy and reliability of the process of valuation.

Understanding the intricate tapestry of an E-commerce business’s value requires meticulously examining various vital drivers. These elements, from financial performance to market trends and operational efficiency, collectively shape the business’s intrinsic worth. In this section, we embark on a detailed exploration of these critical valuation drivers, offering a comprehensive perspective on what truly influences the value of an E-commerce venture. By delving deep into each factor, we aim to equip you with the insights necessary to navigate the dynamic landscape of E-commerce valuations with clarity and precision.

Detailed financial statements are crucial, including revenue, expenses, and profit margins. Additionally, metrics like Gross Merchandise Value (GMV), Average Order Value (AOV), and Customer Acquisition Cost (CAC) provide deeper insights into the business’s financial performance.

Beyond overall revenue, assessing income distribution across different product categories, customer segments, or sales channels is essential. A well-diversified revenue stream can mitigate risks associated with over-reliance on a single source.

Analyzing customer demographics, acquisition costs, and retention rates gives a comprehensive view of customer lifetime value (CLTV). A solid and loyal customer base drives current revenue and signifies future growth potential.

Consider factors like brand awareness, customer perception, and brand loyalty. Brand recognition can positively influence customer trust, leading to higher conversion rates and customer retention.

Beyond traffic volume, evaluating the quality of traffic is crucial. Metrics like bounce rate, time on site, and conversion rates provide insights into the effectiveness of the marketing strategy and user experience.

Growth potential is assessed by examining historical growth rates, market opportunities, and strategies in place for expansion. A well-defined growth plan, backed by data and market analysis, enhances the business’s valuation.

Staying abreast of industry trends, technological advancements, and shifts in consumer behavior is critical. A positive indicator is a forward-looking approach that anticipates and adapts to market changes.

The age of the business can be a factor in valuation. Established ecommerce businesses with a proven track record may have a stronger foundation, while newer companies may present growth opportunities and innovation potential.

Efficient operations management, streamlined processes, and effective cost-control measures contribute to higher profitability. Analyzing operational efficiency and cost structures helps identify areas for improvement.

Evaluating the scalability of the business model is critical. A business that can grow without proportionally increasing costs has the potential for higher margins and increased profitability as it expands.

Assessing the business’s compliance with industry regulations and potential legal risks is crucial. Adhering to legal requirements and minimizing potential liabilities adds to the overall stability and value of the ecommerce business.

Consider any intellectual property assets, such as trademarks, copyrights, or proprietary technology, which can provide a competitive advantage and add to the business’s value.

By conducting a detailed analysis of these drivers, potential buyers, investors, and stakeholders can understand the E-commerce business’s intrinsic value. It’s important to note that these factors are dynamic and may evolve, making periodic reassessment essential for maintaining an ecommerce valuation.

Due diligence is a comprehensive and systematic investigation or examination of a business, investment opportunity, or any significant transaction or decision. It’s a process undertaken to gather detailed information, assess risks, and verify the accuracy of the information provided. This process is crucial in making informed decisions, mitigating risks, and thoroughly examining all relevant facts before finalizing a transaction or investment.

In business, due diligence typically involves reviewing various business aspects. It helps assess a business venture’s actual value and potential risks. For example, before acquiring or investing in a company, potential buyers or investors will conduct due diligence to ensure they clearly understand the business’s financial health, legal standing, and operational efficiency.

Inextricably linked to sound decision-making, due diligence is a foundational process that forms the bedrock of business transactions and investments. Its significance cannot be overstated, as it offers a shield against unforeseen challenges and potential pitfalls. By meticulously scrutinizing financial records, legal documentation, operational workflows, market dynamics, and more, due diligence unveils the complete panorama of the subject matter. This comprehensive understanding empowers stakeholders to make reasonable choices, bolstered by a profound grasp of the intricacies at play. It safeguards against risks and lays the groundwork for strategic growth and sustained success, forging a path toward ventures that are well-considered and poised for prosperity.

Overall, due diligence is critical in making well-informed decisions in any significant business transaction, investment, or strategic move. It provides a foundation of knowledge and understanding upon which sound decisions can be made.

The process of conducting thorough due diligence when evaluating an ecommerce business would include aspects such as:

A detailed examination of the business’s financial statements, cash flow, profit margins, and potential financial liabilities or irregularities.

Ensuring the business complies with all relevant laws and regulations, including licenses, permits, intellectual property rights, and pending legal matters.

Analyzing customer data, retention rates, and feedback to understand customer behavior and satisfaction levels better.

Assessing the strength of relationships with suppliers, inventory management practices, and any potential risks associated with the supply chain.

Conducting a thorough evaluation of the market landscape, competitive positioning, and industry trends to contextualize the business’s performance.

Evaluating the effectiveness and scalability of the business’s technological infrastructure, including the e-commerce platform and any proprietary software.

Analyzing the efficiency of day-to-day operations, assessing the potential for scalability, and identifying any operational bottlenecks.

Confirming the ownership and protection of key intellectual property assets, such as trademarks, copyrights, and patents.

Understanding the effectiveness of customer acquisition strategies and assessing the cost of acquiring new customers.

Assessing the expertise and capabilities of the existing team and any critical talent that may be essential to the business’s success.

Incorporating a section on due diligence will give readers a comprehensive understanding of the thoroughness required in the process of valuation.

Various methods can be employed to calculate the value of an ecommerce business, including Revenue Multiple, EBITDA Multiple, Discounted Cash Flow Analysis, and more. It’s crucial to consider financials, customer base, brand recognition, and growth potential for a comprehensive ecommerce valuation.

The value of a business with $1 million in sales depends on several factors, including industry, profitability, growth potential, and market conditions. A standard method is to apply an industry-specific revenue multiple to estimate the business’s worth.

The formula for valuing a business can vary based on the method used. For example, using the Revenue Multiple method, the procedure would be: Value = Revenue x Multiple. Similarly, other methods have their specific formulas.

Selling an ecommerce business involves several steps, including:

The ecommerce valuation of a business as a multiple of its profit (Profit Multiple) depends on industry norms, growth potential, and risk factors. Generally, ecommerce businesses can be valued anywhere from 2 to 6 times their annual profit, but this can vary significantly based on the specific circumstances of the business and the market it operates in.

In the realm of E-commerce, where innovation and competition converge, understanding the true worth of a business is paramount. Through our exploration of valuation drivers, from financial performance metrics to market trends and operational efficiencies, we’ve uncovered the pivotal elements that underpin an E-commerce venture’s intrinsic value.

Yet, it’s crucial to remember that the valuation process is as much an art as a science. Each business possesses its unique blend of strengths, opportunities, and challenges. Industry landscapes shift, consumer preferences evolve, and technological advancements reshape the digital marketplace.

Ultimately, the value of an E-commerce business is not solely determined by its financials but by its potential, the brand it embodies, and the customer loyalty it engenders.

Remember, there’s no one-size-fits-all approach to valuation. Each business is unique and influenced by its industry, market trends, and operational intricacies. Whether you’re a prospective buyer, seller, or an entrepreneur looking to optimize your business’s value, a comprehensive ecommerce valuation empowers you to make informed decisions.

As you move forward, approach this endeavor with analytical rigor and strategic foresight. Keep your finger on the pulse of industry trends, seize growth opportunities, and fortify the foundations of your business. You can always turn to IntexSoft specialists for help. Contact us for a consultation.