Expand Your Brand to Global Markets: A Guide to Global eCommerce Success

Wondering how to take your online store global? This guide breaks it all down—real stats, major benefits, and smart steps to grow your e-commerce business worldwide. Plus, we spotlight a few global e-commerce giants for inspiration. Questions? Our experts are here for you.

Reading time: 18 min.

For companies chasing scale, “international expansion” is the phrase that shows up when the domestic numbers start to level off. It carries weight—promise, prestige, even pressure. But behind the slide decks and bullet points is a reality few talk about plainly. International expansion is less about going global and more about learning to become local, over and over again.

At first glance, the logic is simple. More countries. More customers. More revenue. But business doesn’t translate like a clean line of code. What works in one region might fail in another. The truth is, moving across borders means walking into a new system of expectations, and you need to be ready to listen, adapt, and act. And that’s where this article comes in.

At IntexSoft, we’ve seen what works—and what unravels. We’re here to show you what to look for, what to plan for, and what to expect when you take that first step beyond your home turf.

Let’s take a closer look.

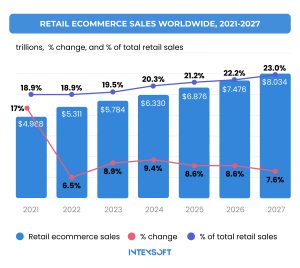

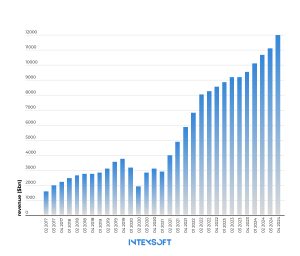

Boston Consulting Group put the projection plainly—e-commerce could claim 41% of global retail sales by 2027. That’s nearly half of everything bought and sold, pulled into the digital stream. Even the more conservative analysts—eMarketer, for one—are still clocking in with an $8 trillion forecast. The implication is direct: consumers are voting with their wallets, at scale.

Look at the parcels. In 2022, 161 billion were delivered worldwide. By 2027, it’s expected to hit 256 billion.

The international picture sharpens it further. Over half of DHL respondents said their biggest opportunity isn’t next door—it’s across borders. The EU, the U.K., Canada, Mexico—they’re targets. And when 80% of global-selling small and mid-sized businesses say their revenue is up from a year ago, it’s more than optimism.

Why is global expansion ecommerce often the smartest move to make? Here are the top 6 important benefits:

| Benefit | What It Means |

| New Markets | Fresh demand. Less competition. Tailored value wins. |

| More Revenue | Saturated at home? It’s new abroad. Global sales = stability. |

| Risk Diversification | One market falls, another rises. Spread the risk. |

| 24/7 Operations | Global time zones mean constant sales and support. |

| Cost Efficiency | Cheaper labor, better logistics, smarter tech. Scale saves. |

| Recurring Revenue | Subscriptions, reorders, global churn-proof growth. |

The smart ones begin not with logistics or sales forecasts but with a simple question: Who already understands this terrain better than we do?

Too many companies mistake international distributors for long-term allies. The difference is critical. A distributor might move your product. A partner will help build your reputation. The latter knows how pricing lands, how your message sounds, how your brand will be received—and can tell you what won’t work before you find out the hard way.

Calculating TAM (Total Addressable Market) and SAM (Serviceable Addressable Market) is the minimum due diligence. But raw figures don’t reveal nuance. Numbers won’t tell you how consumers behave, or where regulators will tighten the screws. The best operators pair data with street-level knowledge. They walk the markets. They observe, quietly, until the numbers come alive in context.

Global expansion is never plug-and-play. Language changes behavior. Culture changes expectations. A feature that sells in one region may fall flat in another. Payment preferences vary. So does price sensitivity. Tailoring your offering isn’t about marketing—it’s about respect.

There’s a misconception that translation solves everything. It doesn’t. Words are surface. Culture runs deeper. Whether it’s privacy norms, humor, colors, or customer service etiquette, your product and brand must feel native—not foreign. You’re entering someone else’s home.

It means finding talent who knows the back channels, the regulators, the media landscape, the business customs. Build a team that is legally local and operationally integrated. This takes time. But speed isn’t the measure of success here—resilience is.

Before a single unit is shipped or a landing page goes live, there’s a more basic question: Can your message be understood—accurately, authentically, and without assumption? How much of the population speaks your language? What’s their comfort level with global brands, digital interfaces, or foreign transactions? That intersects with another hard variable—purchasing power. GDP per capita is a clue. It tells you if your offer is aspirational, attainable, or invisible. Skip this step, and you’re flying blind.

When your customers are ten hours ahead and waiting on answers, patience wears thin. The companies that last in global markets don’t just operate globally—they respond globally. That means hiring for fluency, not just in language but in urgency. They build around time zones, not calendars. Offices, support, response protocols—they’re shaped around when the customer needs them, not when it’s convenient for the company. It’s about infrastructure.

Executives love the idea of going international—until the ambiguity starts costing money. The word itself—international—says nothing. Success lives in the specifics. Which region? Which country? What city? What population segment? You need to carve down to the places where your product fits into a real, unmet need—culturally, emotionally, practically. Test one region. Learn. Adjust.

You can’t sell if you don’t understand what people want—or why they want it. That goes deeper than data. It touches history, rituals, taboos, rhythms of daily life. Ask the hard questions: What need are we meeting? Are we improving something—or imposing something? Markets don’t respond to outsiders who barge in with assumptions. They respond to brands that listen, adapt, and communicate with cultural fluency. You have to feel native.

Numbers help. So do reports, white papers, and competitive analyses. But what separates the armchair strategist from the successful international operator is presence. Being there. Walking the streets. Visiting the shops. Watching how people browse, ask questions, and compare prices. The market will tell you the truth—if you’re willing to listen to it directly, not just through filtered data. No consultant can replace the instincts built by first hand observation.

The fact is that trillions move through e-commerce pipelines every year, flowing across borders, time zones, and platforms. Global ecommerce market size rises. The idea that a serious company today wouldn’t engage with the digital marketplace becomes more and more strange.

In 2025, a few names are true leaders, baked into the way modern economies now move:

What began as an online bookstore has become the world’s most powerful digital marketplace. Last year $638 billion in sales. A market cap of over a trillion. But those numbers don’t tell the full story.

Amazon built something deeper than logistics and selection—it built habits. It embedded itself in people’s daily lives. Personalized search. Prime delivery. The one-click buy. Amazon chases convenience; it rewrote the script for consumer expectations. And it did it methodically—starting with customer reviews in 1995. A simple idea that turned passive buyers into participants.

Across the Pacific, a different playbook. Alibaba wasn’t a replica of Amazon. Founded in 1999, it became the backbone of China’s digital economy.

Instead of owning logistics, Alibaba orchestrated them. Cainiao now moves 30 million packages a day. The group carved out dominance in every vertical: B2B with Alibaba.com, C2C through Taobao, and B2C on Tmall. In scale and design, Alibaba truly competes.

Based in the Netherlands, Prosus is a web of investments. Online classifieds, edtech, fintech, food delivery—it’s all in the portfolio. What makes Prosus different is its philosophy. It backs technology and bets on the social architecture behind it. Local markets. Emerging economies. Homegrown talent.

Travel changed, and Booking.com was there before most knew how. Based in Amsterdam, the platform normalized online reservations. The interface is clean, almost intentionally boring. But behind it is a system built for speed and precision, matching people with places around the clock. Owned by Booking Holdings, the platform’s influence stretches beyond its homepage. Across the travel industry, it sets expectations on pricing, availability, and user trust.

This company is running operations in over 70 countries.

But the numbers don’t explain the reach. Uber moved into food delivery, freight, and even healthcare. It understood the mobile interface better than most—what it could do, how far it could stretch.

The question’s been floating around executive meetings and analyst calls for years now—who’s going to win this thing? The global ecommerce race.

Sure, the big names—Amazon, Alibaba, maybe a few more—have a head start. They’ve spent years building muscle, reputation, and infrastructure. These companies have the kind of brand recognition that still bends markets. They can act global because, frankly, they already are. But that doesn’t mean the next wave of players will be locked out. It just means the road ahead won’t be the same road these giants took.

At home, scaling an online business can feel almost natural. The systems are familiar. The user behavior is predictable. But once you step beyond borders, you face new rules, new expectations, and new competition.

Is your team ready to build for scale without losing sight of where you’re landing? That’s where IntexSoft comes in. Methodically helping you build for the long haul—one market at a time. Contact us.