Why Legacy Payment Systems Are Holding Back Financial Services Modernization—and How to Fix It

In this article, we show the risks, the friction points, and the innovation dead zones of legacy infrastructure. We also break down the 10 real-world benefits of modernizing, from cutting downtime to attracting next-gen talent. Short on developers? Still unsure where to start? Contact our experts for a free consultation and bring your stack into the now.

Reading time: 19 min.

Legacy payment systems are the financial industry’s Achilles’ heel.

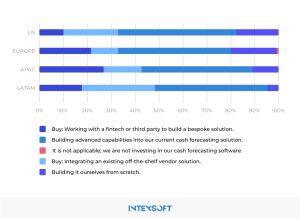

Today, real-time transactions, AI-driven insights, and predictive analytics have become the norm. But too many banks are still clinging to tech from the dial-up era. The statistics speak clearly: 73% of financial institutions are still entangled in legacy systems, slowing down everything from payments to progress.

And while 61% of banks now claim they’re building their own tech stacks, only 22% are actually starting from scratch. The rest? They’re bolting shiny new tools onto aging infrastructure—like installing a Tesla dashboard in a steam engine. The result: complexity, fragility, and a growing mountain of technical debt.

The cost is truly massive. Up to 70% of IT budgets are spent maintaining outdated systems—money that could be fueling tech innovation. Worse, if left unchecked, these legacy platforms could bleed the industry for $57 billion by 2028.

Fintechs aren’t waiting around. They’re already moving, and customers expect nothing less. Banks must modernize—or become irrelevant.

In this article, IntexSoft breaks down how to fix what’s broken. We explore the tech, the strategy, and the transformation banks need now.

Let’s dive in.

As we have already mentioned above, one-third of IT budgets at traditional banks are consumed by the upkeep of legacy systems—aging frameworks patched and repatched, year after year. Executives privately admit that these systems can’t scale and that a single failure could ripple through entire operations. Billions are spent preserving the past, not building the future.

Legacy systems were built before the cloud, before APIs, before zero-trust architecture. They simply weren’t designed for today’s threat landscape. That means financial institutions are not only slower to detect breaches—they’re often blind to them altogether. Meanwhile, cybercriminals are exploiting these cracks with growing frequency.

The longer banks wait to modernize, the deeper the hole becomes. Every legacy platform is a liability dressed as tradition. And in a world driven by AI, APIs, and automation, hanging on to legacy tech is truly dangerous.

Originally built for batch processing and 9-to-5 banking, these aging platforms buckle under the pressure of today’s always-on economy. Transactions that should take seconds crawl through outdated workflows. System slowdowns become routine during peak hours. And forget about real-time insights—legacy architectures simply aren’t wired for it.

These bottlenecks ripple across entire organizations. Trading systems delay execution. Mobile apps freeze or crash. Back-office teams waste time manually patching together reports.

Users expect instant access, intuitive design, and personalized insights. Legacy systems were never built for omnichannel access or real-time personalization. They weren’t built for mobile-first banking, or smart notifications, or voice commands. They were built for tellers behind glass and transactions that could wait until Monday.

Meanwhile, fintech challengers are onboarding users in minutes and offering seamless digital journeys powered by AI and cloud-native speed. For traditional banks still dragging their feet, the UX divide is growing—and so is customer churn.

Poor UX damages brand perception, negatively impacts engagement, trust, and revenue.

Most legacy tech stacks simply don’t play well with others.

Banks trying to integrate modern features—like instant payments, fraud detection AI, or customer analytics—end up cobbling together workarounds that slow everything down. Every new tool needs a custom patch. Every integration is a small crisis. It’s like trying to plug USB-C into a rotary phone.

Let’s talk about the code no one wants to touch—and the crisis no one’s talking about. While banks pour billions into digital innovation, many are still running on tech so old it might as well be fossilized. Think COBOL, a programming language that predates the moon landing and still powers core systems at global financial institutions.

Here’s the problem: no one knows how to use it anymore.

As developers fluent in COBOL retire, financial institutions face a ticking time bomb. There’s no new generation lining up to take their place. Universities stopped teaching it decades ago, and most young engineers would rather debug AI models than dive into 60-year-old syntax. When something breaks— and it will—finding someone to fix it is a challenge.

This is inconvenient, risky, expensive, and unsustainable. Emergency COBOL consultants charge a premium.

The talent shortage around legacy tech has become one of the industry’s most underrated threats.

That’s why forward-looking business owners are turning to modernization partners, especially in Eastern Europe. IntexSoft’s teams understand the legacy stack and know how to break free from it. We’re rebuilding core infrastructure with modern languages, scalable architectures, and future-proof APIs. Contact us anytime.

Here are the key approaches that are actually moving the needle for banks and financial players:

| Approach | What It Means | Why It Matters | Example Outcome |

| Core Banking System Overhaul | Replace legacy core systems with modular, cloud-native platforms | Enables real-time processing, faster innovation, and long-term scalability | Faster product rollout, reduced downtime |

| Cloud Migration | Move from on-premise to cloud—re-architect, not just lift-and-shift | Unlocks scalability, resilience, and access to AI/ML and analytics | Enhanced data insights, elastic computing power |

| API-First Architecture | Design systems to be interconnected and open via APIs | Powers open banking, easier fintech integrations, and agile service expansion | Seamless third-party payment or lending integrations |

| Microservices Architecture | Break applications into smaller, independent services | Increases system flexibility, isolates risk, and supports faster development cycles | Quicker feature deployment, lower operational risk |

| DevOps & CI/CD | Adopt modern development practices and continuous deployment pipelines | Improves agility, reduces time to market, and fosters innovation culture | Weekly releases instead of quarterly updates |

| Fintech Partnerships & Outsourcing | Collaborate with fintechs or outsource to modernization experts | Fills skill gaps, reduces costs, and accelerates transformation efforts | Eastern European teams modernize legacy systems at a decent cost |

| Zero-Trust Cybersecurity | Rebuild security with modern principles—trust no one, verify everything | Protects against today’s evolving cyber threats, especially in API-driven, cloud-native ecosystems | Real-time threat detection, compliance-ready infrastructure |

Every time a financial institution delays modernization, it gambles with its future. Core systems built on COBOL or other outdated languages are difficult to maintain, and they’re nearly impossible to scale.

Then there’s fragility. As we highlighted above, legacy platforms were never designed for the velocity of today’s markets. They can’t handle real-time payments at scale, integrate easily with APIs, or adapt to evolving compliance requirements. As a result, each workaround adds more technical debt.

Let’s look at the risks and challenges that define legacy system.

Legacy systems grind away in the background, more clunkier with every update. They chew up time, people, and budget. And while no red alarms go off, the damage compounds daily in the form of operational inefficiencies.

Every process built on aging infrastructure becomes a bottleneck. Batch processing instead of real-time transactions. Manual workarounds for what should be automated. Endless maintenance cycles just to keep things “working.” It’s death by a thousand micro-latencies—and it’s costing banks millions.

Fragmented systems mean data silos. Teams spend more time chasing down reports than making decisions. Compliance becomes a manual crawl. Innovation grinds to a halt because developers are too busy patching legacy code to build anything new.

Worse, these inefficiencies are invisible to customers—until they aren’t. A delayed payment here, a failed transaction there, a clunky interface that makes users click ten times to do one thing. The friction adds up. And so does customer frustration.

Fintechs don’t operate this way. They’re lean. Modular. Automated. They move fast, scale easily, and iterate weekly, not annually. Every inefficiency that traditional banks accept as “just the way it is” becomes a market advantage for the competition.

Here’s the bottom line: operational inefficiency is not a minor nuisance. It’s a strategic liability. It inflates costs, cripples agility, and widens the gap between what legacy institutions can deliver—and what modern customers demand.

Built in an era before GDPR, PSD2, or the rise of real-time fraud monitoring, outdated financial infrastructure is straining under the weight of today’s compliance demands.

These systems weren’t designed to adapt. They were built to endure. But in a world where regulation moves faster than ever, endurance is no longer enough.

Let’s get real: compliance today means instant audit trails, encrypted communications, cross-border data handling, and the ability to respond to new rules fast. Every new mandate becomes a major IT project, draining time, talent, and resources. Meanwhile, regulators aren’t slowing down.

Worse, legacy systems create blind spots. Disparate databases and siloed processes make it harder to produce clean, accurate records, let alone in real time. That’s not just inefficient. It’s risky. One missed reporting deadline. One poorly tracked transaction. One noncompliant process buried in old code. That’s all it takes to trigger fines, audits, and a PR nightmare.

Global banks paid over $10 billion in compliance fines in 2023 alone. Much of that can be traced back to poor data visibility, weak reporting systems, or outdated infrastructure unable to handle the regulatory load.

The truth is that when your application lags, your chatbot misfires, or your online portal crashes during a transaction, customers don’t see “legacy infrastructure” and don’t stick around for apologies.

Today’s users—especially digital-native Gen Z and mobile-first millennials—expect real-time updates, smooth interfaces, and personalized experiences. They want banking that feels as intuitive as Spotify and as fast as Amazon. What they get instead, in many traditional institutions, are clunky interfaces built on systems older than their smartphones.

The result? Frustration. App abandonment. Account closures. And in an age where switching banks is easier than ever, the cost of dissatisfaction is truly brutal and immediate.

Fintech challengers are winning not just because of better rates or flashier marketing—they’re winning because their systems work. Seamlessly. Predictively. Invisibly.

The best way to lose customers is to avoid modernization.

Staying legacy is staying behind. Modernize and leverage many benefits in the foreseeable future:

Legacy systems think in batches. Modern platforms think in nanoseconds. Real-time processing means transactions clear instantly, analytics happen on the fly, and customers get feedback before they even realize they have a question.

Try launching a new product on a legacy core. Now try it on a modern, modular architecture. With updated systems, development teams can build, test, deploy, and iterate at a velocity fintechs are built on. Microservices architecture? Check. APIs that talk to each other? Absolutely.

Modern systems integrate natively with payment gateways, KYC tools, AI engines, and anything else you need to plug in. That means smoother onboarding, faster deployments, and a tech stack that scales without hacks.

New systems are built for a world where cyber threats evolve daily. That means encryption by default, access control baked into the codebase, automated compliance audits, and real-time threat detection. No more “we’ll add the firewall later.” Security becomes proactive, not reactive.

Custom-built or well-selected platforms reduce long-term costs by slashing maintenance, minimizing downtime, and streamlining development. You spend less time fixing old problems and more time building the future.

In legacy systems, data lives in silos, sprawled across formats no one remembers how to decode. Modern infrastructure brings it all together. Unified data lakes, streaming pipelines, and AI-ready formats. That means better insights, real-time dashboards, and machine learning that actually learns. Your decisions stop being guesses.

Modern platforms mean seamless apps, instant responses, and deeply personalized experiences. From real-time notifications to intelligent UIs that adapt to behavior, modern systems let you build what customers expect, not what your old stack can tolerate. You don’t just catch up—you leap ahead.

With built-in support for GDPR, PSD2, SOC 2, and whatever regulations’s around the corner, modern systems let you stay compliant without breaking a sweat. Every transaction is traceable. Every record is audit-ready. No more manual spreadsheet gymnastics to satisfy a regulator.

Tech evolves fast. Platforms that aren’t modular, flexible, and cloud-native are dead weight. Modernization means building for what’s next, whether that’s AI, blockchain, or APIs that haven’t even been invented yet.

Updating your stack helps attract the best talent—and keep them around. That’s how you turn legacy IT from a liability into a competitive asset.

Yes, bleeding-edge tech is thrilling. Real-time analytics, AI-driven automation, cloud-native everything—it’s the stuff CIO dreams are made of. But legacy systems aren’t just dead weight. They hold your data, your workflows, your institutional memory. You don’t just rip and replace. You evolve.

Just look at some legacy systems examples still powering mission-critical operations: COBOL-based banking platforms, mainframe-driven insurance databases, on-prem ERP software from the early 2000s. These systems might be dated, but they’re deeply embedded—and still performing. That’s why modernization can’t be a wrecking ball. It has to be a scaffold.

Modernizing isn’t about abandoning the old—it’s about syncing it with the new. It means bringing observability into your stack so nothing breaks in the dark. It means bridging outdated infrastructure with modern platforms through smart integration, not brute force. And if you want resilience, flexibility, and scalability, you need to make legacy systems composable. That means breaking down monoliths into interoperable parts that can plug into newer tools, APIs, and architectures without friction.

And most importantly, it means accepting that transformation isn’t a one-click install. It’s a process. A mindset. A strategy.

Done right, modernization becomes more than a tech initiative—it becomes a competitive edge. When you align legacy with innovation, you don’t just move faster. You move smarter.

That’s where IntexSoft comes in. We help future-proof your financial systems without losing what got you here. Our experts are ready to map the journey—without the stress, without the data loss. Reach out for a free consultation. The future doesn’t wait. And now, neither do you.