This post explores top ecommerce fraud solutions to protect against fraud, including tools like verification software, IP fraud scoring, and maintaining PCI compliance. Other strategies include manual order reviews and limiting purchase quantities. Read on to discover more measures to avoid these and many other challenges.

Reading time: 27 min.

E-commerce fraud is a severe problem online, where people use tricky or illegal tactics to get money, goods, or services unlawfully. They exploit weaknesses in online payments, ID checks, and trust between buyers and sellers. Fraud can happen in many ways, like stealing payment details or taking over someone’s account. It’s a big issue that shows why we need strong security measures to protect businesses and customers from losing money or trust.

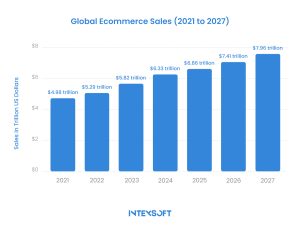

The reality is that the e-commerce sector is a favorite target for fraudsters. Forecasts predict a steady increase in global e-commerce sales, expected to surge to $7.41 trillion by 2026. The answer is clear – the e-commerce market is growing rapidly, adopting new technologies, and constantly adapting to changing conditions. However, these advancements also bring about certain bottlenecks. Fraudsters carefully monitor vulnerabilities and gain more opportunities to exploit them to their advantage.

The data above shows that cybersecurity remains a crucial trend in e-commerce in recent years.

Although the online store’s growth rate has slowed from the peak during the pandemic, the future still looks bright, which attracts fraudsters. For every $100 worth of fraudulent orders, there are losses amounting to $207. Given that online sales present a lucrative target, so online retailers must manage fraud effectively.

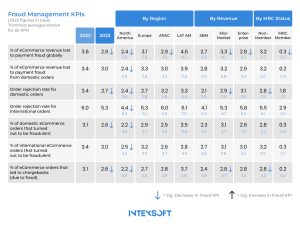

You can gauge how well this management works by looking at the statistics below:

Recent research should encourage you, as an online store owner, to learn more about detecting fraud and implementing strategies for ecommerce fraud prevention. IntexSoft will have you covered. Read this article to find all the details.

Is it the case that certain businesses face a higher risk than others? While all online businesses are susceptible to fraud, there is a factual basis that indicates online retailers, payment processors, and few other sectors are more frequently singled out by fraudsters. Let’s uncover the potential vulnerabilities at play within this landscape.

| Type of Business | Why Is Fraud Prevalent for this Type? |

| Online retailers | These businesses, serving as the digital conduits between products or services and eager customers, face a dual challenge. They have to manage the sheer volume of transactions while safeguard the sensitive customer data they accumulate. Very accessibility also makes online retailers prime targets for fraudsters seeking to exploit vulnerabilities in payment systems, customer databases, and cybersecurity protocols. Fraudsters may employ various tactics, from stolen payment information to account takeovers and identity theft. Moreover, the collection of sensitive customer data, including personal information, payment details, and purchase history, amplifies the risks associated with online retail. |

| Payment processors | The obvious thing that comes to mind is that such processors have a spectrum of duties. They process credit card payments and manage online payment gateways. Their main goal is to guarantee that the monetary exchange between parties flows smoothly and securely. Any security compromise can lead to financial losses and even hit the reputation really hard. |

| Digital content providers | Ranging from streaming entertainment to e-books and state-of-the-art software solutions, these providers offer a diverse selection of products and services. To bypass the system of protection, fraudsters employ tactics that often yield successful results. This includes hacking into systems to access content without authorization or distributing pirated copies of digital products unlawfully. These actions not only undermine the revenue streams of digital content providers but also pose significant challenges in upholding the integrity and security of digital assets. |

| Subscription-based services | They symbolize a modern business paradigm, providing a comprehensive suite of services that include online courses, software-as-a-service platforms, and membership sites. Despite their customer-centric approach and added value, these services encounter specific hurdles related to fraudulent behaviors. Fraudsters might resort to using stolen credentials or false identities to set up accounts and use services without genuine purposes, leading to financial losses and disruptions in operations. Unauthorized access to services is another threat that subscription-based businesses must address. Fraudsters may attempt to circumvent authentication measures or exploit vulnerabilities in systems to gain access to premium content or features without proper authorization. |

| Online marketplaces and auction sites | Online marketplaces and auction sites serve as bustling hubs where numerous sellers and buyers converge. However, this bustling activity also attracts the attention of fraudsters, who exploit weaknesses for their gain. The most common forms of fraud include fake listings that deceive buyers and the sale of counterfeit products. Additionally, payment scams or unauthorized purchases are prevalent issues that can impact both buyers and sellers. |

| Sites for booking travel and events | Businesses that facilitate reservations for flights, hotels, and various events must maintain a vigilant stance. Fraudsters often employ two deceptive methods: making false bookings or using stolen credit card details. The consequence is a loss of revenue for booking sites and disruption of travel and event plans for legitimate customers. |

This is not a monolithic threat. These tactics continually evolve, posing dynamic challenges for businesses and customers alike.

Let’s delve into various categories of e-commerce fraud that demand understanding from both businesses and customers:

Despite its seemingly innocuous name, friendly fraud is a deceptive practice that plagues ecommerce transactions. What does it mean? Customers making purchases online and subsequently disputing or filing chargebacks for legitimate transactions. They often claim that they did not receive the goods or services as described, exploiting loopholes in the system.

The term “friendly fraud” can be misleading as it implies a friendly or accidental nature, which is not the case in reality. Instead, it leads to revenue loss and spikes in chargeback fees for businesses.

Friendly fraud can stem from various factors, ranging from genuine misunderstandings and buyer’s remorse to deliberate deception by customers. It presents a significant challenge for businesses as it often involves genuine customer accounts and transactions, making it difficult to differentiate from legitimate claims.

Typically initiated during the early phases of a cyberattack, this fraud modus operandi gains traction when hackers successfully breach databases housing credit card details.

The mechanics of card testing fraud are intricate. Fraudsters utilize automated tools or scripts to feed stolen credit card data into e-commerce platforms. Through inconspicuous, small-scale transactions, they assess the validity of the card details, striving to evade detection triggers like fraud alerts.

The primary objective behind card testing fraud is to pinpoint operational credit card numbers capable of fueling more substantial illicit transactions in the foreseeable future. This method is a preemptive measure for cybercriminals, ensuring the viability of stolen card data before leveraging it for significant purchases or trafficking it on the dark web.

This popular scheme involves purchasing items with the full intent of later seeking a refund despite receiving the goods in satisfactory condition.

This deceptive maneuver often involves a layer of dishonesty, with customers misleadingly claiming product defects, inaccurate descriptions, or non-delivery to justify their refund requests. Sometimes, they maneuver the return process to obtain a refund while retaining the purchased items.

Detecting refund abuse poses a significant challenge, mainly when fraudsters employ various strategies to camouflage their illicit activities.

This type strategically targets the very systems that facilitate online transactions. First of all, it is about credit card dealings, digital wallets, and some other electronic payment avenues.

The modus operandi of fraudsters in this domain is versatile. They can use phishing schemes to extract credit card details or breach payment gateways to gain illicit access to customer accounts. They can also exploit stolen credentials for unauthorized purchases or manipulate payment pathways to reroute money for personal gain.

This scheme unfolds when fraudsters illicitly gain access to crucial account details, such as usernames, passwords, or security questions, utilizing tactics like phishing, data breaches, or social engineering ploys.

Once perpetrators have infiltrated an account, they can make unauthorized purchases, alter account settings, or clandestinely pilfer sensitive information. The ramifications of account takeover fraud are far-reaching. They go beyond financial losses for businesses and customers alike, tarnishing the reputation of all affected parties.

Promo, affiliate, or loyalty abuse represents a subtle yet pernicious threat.

Through a web of fabricated accounts, automated algorithms, and calculated manipulations, fraudsters deftly exploit the weak points of promotional systems. As a result, they reap rewards they never rightfully earned. Online stores get inflated marketing costs.

This is a truly sophisticated maneuver in e-commerce. Unfolds with a trio at its core: the fraudster, an unwitting customer, and a reputable seller. The fraudster employs stolen credit card details or illicit payment methods to make seemingly legitimate purchases from the seller. Yet, here’s the twist – rather than directing the goods to their own doorstep, they divert them to the unsuspecting customer.

This deception serves a dual purpose for the fraudster. First, it veils their true identity and location, shrouding their tracks in a web of innocent transactions. Second, it exploits the trust the seller places in fulfilling the order, oblivious to the fraudulent orchestration at play. As a result, the customer, upon receiving the goods, remains unaware of the scam’s intricacies.

Here’s a breakdown of the key factors fueling ecommerce fraud, along with descriptions and effective prevention methods proven in practice. It won’t take much time to read, just a few minutes. However, if you need more detailed information, you can find it in the takeaways below this table.

| Cause | What does it Mean? | Impact on Businesses | Ways to Prevent |

| Payment vulnerabilities | All of them depend on flaws in payment processing systems, such as insufficient encryption or authentication measures. If your online store has these bottlenecks, it creates additional opportunities for fraudsters. The result is unauthorized transactions. | – Financial losses. – Damage to reputation and customer trust. | – Robust encryption and authentication methods. – Keeping payment systems and security measures up to date. |

| Data Breaches | We mean breaches in ecommerce platforms or third-party services that expose customer data (credit card details). | – Legal consequences in mishandling client data. – Lack of user trust and loyalty. | – Encryption. – Secure APIs. – Regular security audits. – Continuous education of employees on data protection best practices. |

| Phishing and Social Engineering | This includes some deceptive tactics, such as phishing emails or fake websites, used to trick individuals into disclosing personal or financial information. | – Identity theft and financial fraud. – Potential legal liabilities from compromised client data. | – Users’ education on recognizing phishing attempts. – Email and website authentication measures. – Anti-phishing tools. – Employee training programs. |

| Weak Authentication | This point depends on poor user authentication practices. Weak passwords or the absence of multi-factor authentication can hit the online store hard. Fraudsters can gain access to user accounts without great effort or complex methods. | – Higher risk of account takeovers. – Unauthorized transactions. – Loss of user confidence in online store security. | – MFA. – Strong password policies. – Biometric authentication. – Continuous monitors and detects every suspicious login attempt. |

| Account Takeovers | This revolves around phishing and malware attacks. The ultimate goal is to gain control of legitimate user accounts. | – Financial losses from fraudulent purchases. – Damage to client relationships and trust. | – Real-time fraud monitoring. – Detection systems. – Account activity notifications. – Secure password recovery processes. |

| Fraudulent Returns and Chargebacks | Refund abuse or false chargebacks give fraudsters the unique opportunity to obtain refunds or reversals for products they never legitimately purchased. | – Increased chargeback fees. – Revenue losses. – Negative impact on inventory management and cash flow. | – Verification orders and returns with solid attention. – Fraud detection tools to flag suspicious refund requests. – Customer communication on return policies. |

| Inadequate Fraud Detection Systems | If the online store or platform lacks robust fraud detection tools, the business will struggle to effectively identify and prevent fraudulent activities. | – Higher incidence of undetected fraud incidents. – Potential regulatory fines for compliance failures. | – Investing in advanced fraud detection software and machine learning algorithms. – Regular fraud risk assessments. – Staff training. |

| Global Nature of Ecommerce | In the case of expansive ecommerce platforms, the risks become even more dangerous and really tricky. We mean cross-border fraud and regulatory complexities, necessitating heightened vigilance. | – Challenges in legal jurisdiction and enforcement. – Compliance issues with international data protection regulations. | – Geo-location checks and IP filtering. – Partnership with reputable payment gateways. – Adherence to international security standards. |

| Rapid Growth of Ecommerce | The expansion of ecommerce in quantum leaps has sometimes outpaced security measures, creating gaps that fraudsters exploit. | – Scalability challenges in retail fraud prevention. – Increased competition. – Pressure to deliver seamless customer experiences. | – Regular security audits. – Continuous risk assessments. – Investing in agile and scalable fraud prevention ecommerce solutions. |

| Lack of Customer Awareness | Fraudulent schemes become successful if your customers are not aware of common fraud tactics and safe online practices. | – Higher vulnerability to social engineering attacks. – Difficulty in distinguishing legitimate from fraudulent activities. | – Customers should be educated on safe online practices and fraud prevention tips. – Clear guidance on detecting and reporting suspicious activities. |

Certainly, fraudsters often employ sophisticated methods that aren’t always easy to detect. But there are relatively straightforward indicators that can help you recognize when your online store and customers are under attack. What are these indicators? Let’s explore them through our top list:

Of course, the first thing you should be worried about is a sudden surge in order volumes. Malefactors, armed with purloined credit card credentials, always favor the most high-ticket goods. They do it quickly as the capital they expend is not their own.

This point contrasts with the one above. Often, fraudsters purchase low-value products (around $1) to test the validity of stolen cards. Have you noticed such orders? If so, scrutinize them with extra care, as these behaviors are pretty unusual.

Why is it suspicious when one customer makes several purchases, each using a different credit card? This is a common tactic among scammers worldwide to conceal their activities and evade detection. They do this to test if stolen credit card details are still usable. This behavior raises questions about the legitimacy of the transactions and warrants scrutiny.

As a rule, fraudsters lack crucial information to execute transactions using stolen cards. Thus, repeated payment declines due to security code errors suggest a deliberate attempt at deception, not an innocent oversight by a genuine customer. Keep that in mind.

Keep a close watch on multiple orders originating from a single IP address or dubious orders from unfamiliar locations. For instance, in a scenario where most of your clientele is based in Germany, an attempt at a significant purchase from an IP address located in India is a glaring indicator of potential ecommerce fraud.

This often happens in triangulation fraud, where scammers use stolen card info to send goods to real customers.

Yes, online stores often prefer this shipping method, making it truly ubiquitous. The danger lies in PO boxes providing scammers with anonymity to ship online orders. Exercise caution when sending numerous orders to a single PO address.

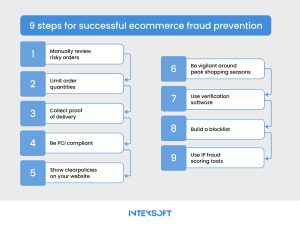

Nothing is more crucial than fortifying your defenses against fraud. It’s not just about protecting your business; it’s about preserving your customers’ trust in you. Here are the essential ecommerce fraud prevention best practices, technical measures, and operational strategies for your online store to stay protected:

Stay on high alert during peak seasons for shopping. Holidays or major sales events always can become hotspots for fraudsters. Boost surveillance and scrutiny of transactions during these times. Employ ecommerce fraud prevention tools and analytics to spot any irregularities or behaviors that hint at fraudulent activity. Educate your team to spot warning signs and escalate any suspicious orders for thorough investigation.

Ensure that your website articulates your fraud prevention protocols and procedures with utmost clarity. This encompasses guidance on how customers can flag suspicious activities and the measures you undertake to safeguard their data. Incorporate robust authentication protocols like multi-factor authentication to fortify security and deter unauthorized entry. Continuously review and refine your policies to uphold their efficacy and compliance with industry standards.

In the fight against ecommerce fraud, a wise decision is to integrate robust verification software into your ecommerce platform. Why is this crucial? Such software can verify the authenticity of user information, including addresses and payment details, thus reducing the risk of fraudulent transactions.

Your online store should also leverage identity verification tools capable of authenticating users through various methods, such as document verification, biometric authentication, or device fingerprinting.

Utilize IP fraud scoring tools to gauge the risk associated with each transaction based on its originating IP address. High-risk IP addresses should trigger further scrutiny or even potential rejection.

Incorporate geolocation checks to verify users’ physical locations, adding an additional layer of security against fraudulent activities emanating from questionable locations.

Follow the Payment Card Industry Data Security Standard requirements diligently to guarantee the absolutely protected management of credit card data. This entails encrypting cardholder data, upholding secure networks, and consistently monitoring and testing systems for vulnerabilities.

Employ PCI-compliant payment gateways and processors to conduct transactions securely and safeguard sensitive payment data from unauthorized access.

Deploy dedicated personnel or automated systems to meticulously scrutinize orders marked as high-risk due to predefined criteria (irregular purchasing patterns or questionable payment details).

Carry out comprehensive examinations, encompassing verification of customer information, reaching out to customers for supplementary verification if necessary, and meticulously examining any inconsistencies in the order data.

Establish restrictions on the volume of products permissible for purchase within a single transaction or over a designated timeframe. This measure aids in curtailing the risk posed by fraudulent bulk purchases made with pilfered credit cards.

Keep a vigilant eye on order trends, particularly noting abrupt surges in purchase volumes, particularly for high-value goods. Such anomalies may signify potential fraudulent endeavors and warrant heightened scrutiny.

Mandate proof of delivery for every order. This entails acquiring delivery confirmation signatures or employing traceable shipping methods.

Maintain meticulous records of delivery confirmations, ensuring accessibility for examination in the event of disputes or chargebacks. These records serve as crucial evidence validating legitimate transactions.

Establish and regularly update a fraudster blocklist comprising identified fraudulent individuals, IP addresses, and payment particulars.

Deploy automated systems or tools to consistently monitor and prevent access from entities listed on the blocklist, thus diminishing the likelihood of fraudulent transactions.

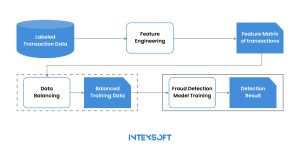

Acquire state-of-the-art software that uses advanced machine learning algorithms and data analysis to detect and stop any fraudulent activities immediately.

Utilize functionalities like behavior analysis, anomaly detection, and device fingerprinting to pinpoint suspicious behavior and preemptively block fraudulent transactions.

This article has revealed why online stores must remain vigilant, especially during peak shopping seasons. We have also discussed clear fraud prevention policies to protect themselves and their customers. You will learn more about technical measures like verification software, IP fraud scoring tools, and PCI compliance. Operational strategies such as manual order reviews, limiting purchase quantities, and collecting proof of delivery further strengthen defenses.

A strong security infrastructure must include maintaining a fraudster blocklist and utilizing advanced e-commerce fraud prevention software. By implementing these best practices and strategies uncovered in this text, online stores will reduce the risk of fraud and maintain trust with their clients.

Integrate all these components into your security infrastructure with IntexSoft. Doing so will enhance your capabilities and detect, prevent, and mitigate ecommerce fraud risks at total capacity.