Want to discover all the essentials of electronic payments in eCommerce? Read this article. You’ll learn about digital wallets, the dominance of mobile payments, cryptocurrency, direct bank payments, and various alternatives. A massive amount of statistical data and predictive analytics is included. As a result, you’ll gain truly valuable insights to help your business thrive. Need advice from an experienced tech company? Contact us. The consultation is free.

Reading time: 22 min.

First of all, we have to acknowledge that the PayTech market has changed drastically, and the changes continue with quantum leaps. They have a significant impact on various industries. For business owners, particularly those in retail, the message is clear: adapt or risk obsolescence. The shift isn’t theoretical. It’s already here.

That is why IntexSoft has put together the big picture in this article. The trends, the statistics, the projections—all of it. What’s happening now, what’s next, and what it means for businesses that rely on digital transactions?

You will be well informed—so read on.

The numbers tell the story. According to the Journal of Modern Science, payment cards and transfer orders—particularly pay-by-link—dominate e-commerce. Vouchers, loyalty points, and PayPal follow. But the real headline? The rejection of cash. Among surveyed consumers, physical currency has become the least desirable payment method for online purchases.

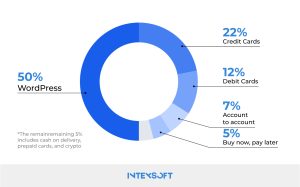

Look at this graph, which highlights the situation in 2023:

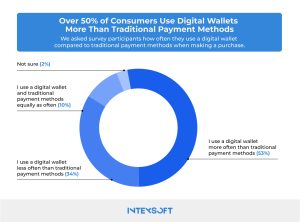

Now, look at Forbes Advisor Research:

As you can see above, the top payment method is the digital wallet, accounting for half of the market. One of the most significant drivers of digitalization was the COVID-19 pandemic.

Let’s support this with statistical findings from Mastercard’s global transaction study, which covered 19 countries.

Here are the key insights:

Visa’s Back to Business Study reinforced the trend:

The future of digital payments is taking shape, and the numbers are hard to ignore. By 2029, the global eCommerce market is expected to hit $11.4 trillion, according to Juniper Research. That’s a 63% surge in less than a decade—fueled by a shift in how people pay.

One of the biggest drivers? Alternative payment methods. Options like Buy Now, Pay Later (BNPL) are changing the way consumers approach transactions, making flexibility and convenience the new norm. As an unlimited amount of businesses and shoppers move away from traditional credit cards, the PayTech landscape is set for a massive transformation.

If you follow the fees, the problem becomes clear. The cost of doing business online is climbing—transaction fees, surcharges, and hidden costs gnaw at profits. Credit cards, once the undisputed king of online payments, are losing their grip. Meanwhile, alternative payment methods are rewriting the rules, forcing businesses to adjust and readjust.

The math is unforgiving.

Every transaction carries a price, and for merchants, that price keeps rising. Payment processors take their cut, banks impose their own fees, and in the end, the merchant pays the bill. For big corporations, it’s an inconvenience. For small and mid-sized eCommerce businesses, it’s an existential threat. A fraction of a percentage point might not sound like much—until it’s siphoning thousands from already thin margins.

At the same time, credit cards aren’t the go-to they once were. Consumers are hesitating. Interest rates are high, security concerns linger, and typing out a 16-digit number feels truly archaic.

It all boils down to four forces shaping the payment landscape:

This factor is a true hidden squeeze on eCommerce.

Interchange fees, charged by banks for handling transactions, keep creeping upward. Payment service providers tack on additional charges. Security and compliance requirements add another layer of costs. The result? Businesses are paying more just to get paid.

It’s not about the percentage taken from each sale. And, as we have mentioned above, small businesses that are already struggling with tight margins are hit even harder. Large online retailers negotiate better rates, but they’re still dealing with rising costs. Some pass the burden onto consumers through higher prices. Others look for alternative payment methods that offer lower fees.

But the reality remains: accepting payments online is becoming more expensive. And for eCommerce business owners, that’s a problem with no easy solution.

For years, credit cards dominated eCommerce. They were the default—fast, familiar, accepted everywhere. But everything is changing. Consumers are moving away, and the numbers tell the story.

It’s not just one factor. High transaction fees make credit cards an expensive option for businesses. Fraud concerns push both retailers and customers toward safer, more secure alternatives. Then, as we have described above, there’s the rise of Buy Now, Pay Later (BNPL) services, digital wallets, and direct bank transfers—faster, cheaper, and often more convenient.

Younger consumers, in particular, are leading the shift. Many don’t even own a traditional credit card. They’re choosing Apple Pay, Google Pay, PayPal, or installment-based options like Klarna and Afterpay. The appeal? No interest rates, no revolving debt, and no surprise fees.

For business owners, it’s a double-edged sword. On one hand, alternative payments often mean lower processing fees. On the other hand, they introduce new risks—higher chargeback rates, regulatory uncertainty, and dependence on third-party platforms.

Yes, credit cards, once the unquestioned kings of online payments are losing ground.

Digital wallets are now standard fare. BNPL services have carved out a dominant niche. Cryptocurrencies, bank transfers, and even loyalty-based payment systems are chipping away at the old model.

Why? Fees and friction. Consumers are tired of dealing with interest rates and overdraft risks, and merchants are exhausted by high processing costs, fraud disputes, and chargebacks. Alternative payments promise something different: speed, security, and often lower costs.

Then there’s the global push. Markets in Asia and Europe have long embraced bank-based payments, QR codes, and super-app ecosystems like WeChat Pay and Alipay. The U.S. is catching up—slowly, but unmistakably. Real-time payments and digital-first banking services are expanding, giving consumers more control and merchants more choices.

Cart abandonment remains one of the biggest revenue killers in eCommerce. And the reason? Often, it’s the payment page.

Consumers don’t just want options—they expect them. A customer finds a product, adds it to their cart, moves to checkout, and then—friction. Their preferred payment method isn’t available. Maybe they don’t have their credit card on hand. Maybe they don’t want to type in a long string of numbers. Maybe they’re wary of security risks. At that moment, the purchase is lost.

Online stores that understand this remove obstacles. Digital wallets, BNPL, direct bank transfers, even cryptocurrency—each method captures a different type of buyer. Apple Pay and Google Pay turn mobile shoppers into instant conversions. PayPal appeals to those who trust its security. BNPL eases financial hesitations.

The impact is measurable. Studies show that adding multiple payment options can reduce cart abandonment by up to 30%. And it’s about psychology. When a payment method feels easy, familiar, and low-risk, hesitation disappears.

Now, as you have already understood the whole picture about factors that dominate in electronic commerce payment, let’s look at the six most important payment processing industry trends from a different angle. Here’s what matters:

| Trend | Description | Impact on eCommerce |

| The Dominance of Digital Wallets and Mobile Payments | Apple Pay, Google Pay, and PayPal are standing tall in online transactions. They truly offer convenience. | Checkout speed, reduces cart abandonment, and enhances security with biometric authentication. |

| Embedded Payments | One-click checkouts and in-app payments remove extra steps, keeping shoppers on the same platform. | Reduces friction, improves experience, and boosts conversion rates. |

| BNPL | Services like Klarna and Afterpay let shoppers split purchases into smaller, interest-free payments. | Encourages bigger purchases, attracts younger consumers, and removes upfront cost barriers. |

| Direct Bank Payments | Open banking and account-to-account (A2A) payments bypass card networks, cutting fees. | Saves businesses money, improves cash flow, and enhances security. |

| Cryptocurrency | Bitcoin and stablecoins are gaining ground, offering new ways to pay—though adoption is still slow. | Expands payment choices, appeals to crypto users, and enables global transactions with lower fees. |

| AI-Powered Payment Security and Fraud Prevention | Smart algorithms detect suspicious transactions, stopping fraud before it happens. | Reduces fraud, lowers chargebacks, and keeps customer data safe. |

Let’s clarify some of these points with additional information.

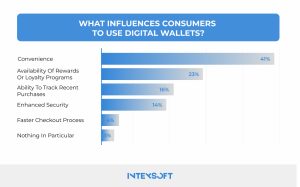

Cash is fading. Cards are next. Among ecommerce payment options, digital wallets and mobile payments are the new standard.

Millennials (75%) and Gen Z (78%) want more than just a payment tool. They expect wallets that store information securely, send funds instantly, and work across borders. PayPal started it. Apple Pay, Google Pay, and Shop Pay accelerated the shift. Starbucks? They turned a coffee app into a financial powerhouse.

We have described many details about this payment method in previous parts of the article, and in this one let’s concentrate on types. How do these wallets actually work?

Payment insiders categorize them by how transactions settle and how funds move. The three primary types:

For the industry, this classification matters. For the consumer? Not so much. Most wallets still rely on credit and debit cards as their foundation. The real battle isn’t over how payments are processed—it’s over who controls the experience.

And that’s where digital wallets are winning.

The question isn’t whether open banking will work. It’s already working. The question is whether it can cement itself like credit cards once did. The trend lines suggest it will. Payments don’t disappear—they evolve. Faster. Smarter. More secure.

For merchants and consumers, the advantage is clear: choice. And right now, shoppers are walking away.

Open banking could chip away at four of the biggest problems:

Merchants want lower costs. Consumers want fewer hurdles. Open banking delivers both.

Follow the patterns, and you’ll find the truth. AI in payment security isn’t just an upgrade. Fraud is evolving with every breach, every stolen credential, and every loophole left open. And in this digital arms race, machine learning has become the frontline defense.

The technology reacts and predicts. By scanning millions of transactions in real-time, AI spots anomalies before they turn into financial disasters. A purchase that doesn’t fit a customer’s spending habits, an unusual login from another country, a split-second inconsistency in behavior—AI sees it all, flags it, and stops fraudsters before they strike.

But fraud prevention is only one piece of the jigsaw puzzle. The real breakthrough is predictive analytics. AI isn’t just looking for fraud—it’s assessing risk, calculating creditworthiness, and forecasting cash flow. In B2B transactions, it’s predicting which invoices will be paid on time and which will stall. For eCommerce, it’s analyzing customer behavior to refine payment strategies.

These are some of the major directions IntexSoft sees will shape the electronic commerce payment space in the foreseeable future:

This is the very first prediction that became obvious. Amazon, Netflix, and a handful of digital leaders rewrote consumer expectations, and there’s no going back. Today, personalization is the baseline. Customers demand tailored experiences. When companies fail to deliver, frustration follows. 76% of consumers notice when personalization is missing.

The payments industry is no exception. Every transaction tells a story—where customers shop, what they buy, and when they abandon their cart. Advanced payment solutions for eCommerce, equipped with data-driven insights, are transforming this raw information into precision-targeted offers, recommendations, and—most importantly—payment options.

Consumers want payment experiences that align with their habits, whether it’s a frictionless one-click checkout, a buy-now-pay-later option, or a rewards-based incentive. Online stores that harness this data always boost revenue.

This perspective can have a tremendous impact on international businesses in terms of eCommerce payment solutions. Money moves, but not always fast enough. In a world where stores are increasingly global, cross-border transactions remain tangled in delays, high fees, and outdated infrastructure. The demand for speed, security, and affordability has never been greater.

Companies like Wise have stepped in to streamline international transfers and expose the inefficiencies of traditional banking networks. But this is just the beginning. The future of cross-border payments is being rewritten by technology, and the biggest disruptor could be distributed ledger systems.

Blockchain comes in, as it is a blueprint for a faster, cheaper, and more secure global payments network. With cloud computing and API-driven integrations, financial systems are inching closer to a reality where international transactions settle instantly, bypassing the middlemen that drive up costs and slow things down.

The old model is breaking.

Look at history. The financial world shifts and governments react. Sometimes too late. Sometimes too aggressively. Businesses, banks, and tech giants are forced to maneuver.

Take PSD2 in Europe. It cracked open the banking industry, forcing traditional players to share data with fintechs. That one directive reshaped digital payments, fueling the rise of open banking and real-time account-to-account transfers.

Fraud is the fire that keeps lawmakers up at night. Every data breach, and every stolen identity fuels tighter controls—Know Your Customer (KYC), Anti-Money Laundering (AML), and Strong Customer Authentication (SCA) are now standard. Businesses must comply, or they don’t play.

And then there’s cryptocurrency. Some nations embrace it, regulating it like traditional finance. Others fear it, banning transactions outright. The lack of global consensus is a roadblock, preventing mainstream adoption.

Meanwhile, Central Bank Digital Currencies (CBDCs) are emerging as a state-controlled alternative to private fintech innovation. China’s digital yuan is already in circulation. The EU and the U.S. are exploring their own versions. If widely adopted, CBDCs could change everything.

Would they replace stablecoins? Kill off commercial banks? Or simply coexist? No one knows yet.

A world of 100% digital payments isn’t a matter of if—it’s a matter of when. At IntexSoft, we believe in five years, the payments landscape will be unrecognizable. Compliance demands will tighten. Alternative payment methods will gain ground. Legacy financial institutions will either adapt or fade.

For ecommerce businesses, the challenge is keeping up and making the right moves in finding the right tech partner.

So, the real question is: Who’s leading you into the future? Look for expertise. Track records. Real-world results. Because the payments race is on, and falling behind isn’t an option.